Current Mortgage Rates: Guide to Securing the Best Deal in 2024:

1:Understanding Mortgage Rates in 2024:

Mortgage rates in 2024 continue to be influenced by a variety of economic factors, including inflation, Federal Reserve policies, and the overall health of the economy. As of early 2024, rates have shown moderate fluctuations, reflecting ongoing adjustments in the financial markets. It’s crucial for potential homeowners to keep a close eye on these rates as they can significantly impact the overall cost of a mortgage over its term. Typically, mortgage rates are divided into fixed and adjustable categories, with each offering distinct advantages depending on the borrower’s financial situation and future plans.

For fixed-rate mortgages, the interest rate remains constant throughout the life of the loan, providing stability and predictability in monthly payments. This is particularly beneficial for individuals who plan to stay in their homes for a long period. On the other hand, adjustable-rate mortgages (ARMs) start with a lower interest rate that adjusts periodically based on market conditions. ARMs might be attractive for those expecting to move or refinance before the adjustment period begins. Understanding these options and monitoring market trends are essential steps in securing the best mortgage rate in 2024.

2:Factors Influencing Mortgage Rates:

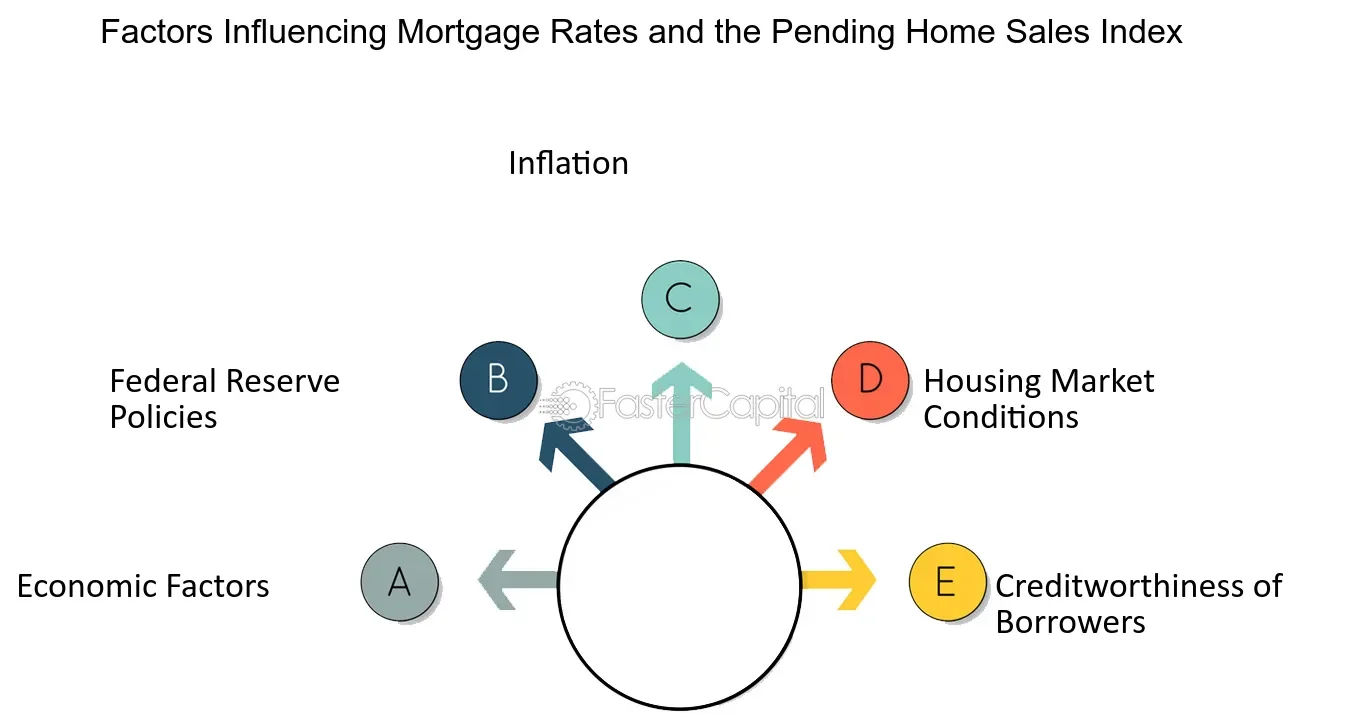

Several key factors influence mortgage rates, making it vital for borrowers to stay informed. One primary factor is the Federal Reserve’s monetary policy, which can directly affect interest rates. In 2024, any changes in the Fed’s policy regarding the federal funds rate can lead to fluctuations in mortgage rates. Additionally, economic indicators such as employment rates, inflation, and GDP growth play a significant role. A strong economy typically leads to higher rates due to increased demand for loans, while a weaker economy can result in lower rates as a measure to stimulate borrowing and investment.

Another crucial factor is the borrower’s financial profile, including credit score, debt-to-income ratio, and down payment size. Lenders offer the best rates to borrowers who present lower risks, which often translates to higher credit scores and substantial down payments. Therefore, maintaining a good credit score and managing debts effectively can provide a significant advantage when negotiating mortgage terms. Furthermore, the type of mortgage and the term length (e.g., 15-year vs. 30-year) also influence the rate offered. Staying informed about these factors and understanding their impact can help borrowers secure more favorable mortgage rates in 2024.

3:Strategies for Securing the Best Mortgage Rate:

Securing the best mortgage rate involves a combination of preparation, research, and timing. First and foremost, improving your credit score is a critical step. This can be achieved by paying off debts, avoiding new credit inquiries, and ensuring all credit report entries are accurate. A higher credit score can significantly lower your interest rate, saving you thousands of dollars over the life of the loan. Additionally, saving for a larger down payment can reduce the loan-to-value ratio, making you a more attractive borrower to lenders and potentially securing a better rate.

Researching and comparing offers from multiple lenders is another essential strategy. Mortgage rates can vary significantly between lenders, so obtaining quotes from several institutions can help you find the most competitive rate. It’s also beneficial to consider working with a mortgage broker who can provide access to a broader range of loan products and rates. Timing your application is also important; keeping an eye on market trends and economic forecasts can help you lock in a rate when conditions are most favorable. By combining these strategies, borrowers can enhance their chances of securing the best mortgage rate in 2024.

4:Government Programs and Incentives:

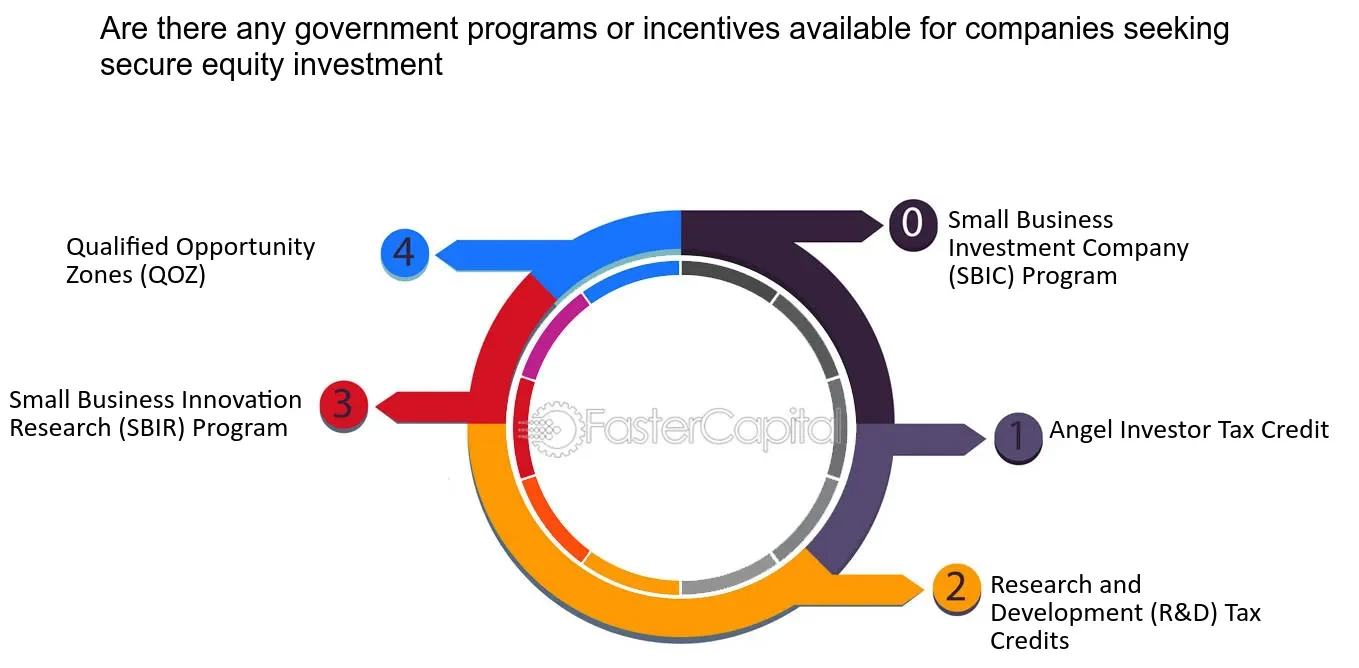

In 2024, various government programs and incentives continue to assist homebuyers in securing favorable mortgage rates. Federal programs such as FHA loans, VA loans, and USDA loans offer competitive rates and favorable terms for eligible borrowers. FHA loans, backed by the Federal Housing Administration, are particularly beneficial for first-time homebuyers with lower down payments and credit scores. VA loans, available to veterans and active-duty service members, often provide lower rates and require no down payment. Similarly, USDA loans support homebuyers in rural areas with low interest rates and no down payment requirements.

State and local government programs also offer incentives that can help reduce mortgage costs. These programs may include down payment assistance, tax credits, and grants for first-time homebuyers. It’s essential to research and take advantage of these opportunities, as they can make homeownership more affordable. Additionally, understanding the benefits of mortgage points—upfront fees paid to reduce the interest rate—can be advantageous. While paying points requires an initial investment, it can lead to substantial savings over the life of the loan. By leveraging these programs and incentives, homebuyers can navigate the complexities of the mortgage market and secure better deals in 2024.

5:Impact of Economic Trends on Mortgage Rates:

Economic trends play a significant role in shaping mortgage rates, and staying informed about these trends is crucial for potential homebuyers. In 2024, factors such as inflation, employment rates, and GDP growth continue to influence the mortgage market. Inflation, in particular, can lead to higher mortgage rates as lenders increase rates to maintain their profit margins in the face of rising costs. Conversely, if inflation remains low, mortgage rates are likely to stay more affordable. Monitoring inflation trends can thus provide insights into future rate movements.

6:The Role of Technology in Securing Mortgage Rates:

Technology continues to transform the mortgage industry, providing tools and resources that help borrowers secure the best rates. Online mortgage calculators, for instance, allow potential homebuyers to estimate monthly payments and compare different loan scenarios based on various interest rates and terms. These tools can aid in budgeting and decision-making, helping borrowers understand the financial implications of different mortgage options. Additionally, many lenders now offer online pre-approval processes, streamlining the application process and making it easier to shop around for the best rates.

The rise of fintech companies has also introduced innovative solutions for securing mortgage rates. Digital platforms can connect borrowers with multiple lenders, offering competitive rate comparisons and personalized loan options. These platforms often use advanced algorithms and data analytics to match borrowers with the best available rates based on their financial profiles. Furthermore, the increased use of blockchain technology in the mortgage process can enhance transparency and efficiency, reducing costs and potentially leading to better rates. By leveraging these technological advancements, homebuyers can navigate the mortgage market more effectively and secure better deals in 2024.

7:Refinancing Opportunities in 2024:

Refinancing can be a strategic move for homeowners looking to take advantage of lower mortgage rates in 2024. By refinancing, borrowers can replace their existing mortgage with a new one at a lower interest rate, reducing their monthly payments and overall interest costs. To determine if refinancing is a viable option, homeowners should consider the current mortgage rates compared to their existing rate, the costs associated with refinancing, and their financial goals. Refinancing can also provide an opportunity to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, offering more stability in monthly payments.

Additionally, refinancing can be used to tap into home equity for major expenses such as home improvements, education, or debt consolidation. Cash-out refinancing allows homeowners to borrow against their home equity while securing a new mortgage at potentially lower rates. It’s essential to carefully evaluate the terms and benefits of refinancing to ensure it aligns with long-term financial objectives. Consulting with a financial advisor or mortgage professional can help homeowners navigate the refinancing process and make informed decisions that optimize their financial well-being in 2024.

8:Conclusion: Navigating the Mortgage Market in 2024:

Securing the best mortgage rate in 2024 requires a combination of preparation, research, and strategic decision-making. Understanding the factors that influence mortgage rates, such as economic trends, Federal Reserve policies, and personal financial profiles, is crucial. By improving credit scores, saving for larger down payments, and comparing offers from multiple lenders, borrowers can enhance their chances of obtaining favorable rates. Additionally, leveraging technology and exploring government programs and incentives can provide valuable support in navigating the mortgage market.

Staying informed about refinancing opportunities and the potential benefits can also help homeowners optimize their mortgage terms and reduce overall costs. As the mortgage market continues to evolve, being proactive and well-informed will be key to securing the best deals. By taking these steps, homebuyers and homeowners can achieve their financial goals and make informed decisions in the dynamic mortgage landscape of 2024.