What Is Commercial Insurance?

Commercial insurance, also known as business insurance, is essential for safeguarding businesses from financial losses due to unforeseen events. These events might include lawsuits, natural disasters, accidents, or property damage that can disrupt a company’s operations. The primary purpose of commercial insurance is to mitigate these risks by offering tailored coverage designed to protect businesses from various types of financial harm.

For example, it can cover physical property damage, legal liabilities arising from lawsuits, or employee-related risks such as workplace injuries. By securing appropriate insurance, businesses can ensure continuity and stability even when faced with significant challenges. Evaluating the right type of insurance involves a thorough assessment of potential risks, which can vary greatly depending on the industry, location, and specific operational practices of the business.

Types of Commercial Insurance:

Commercial insurance offers a range of coverage options to address different risk factors. Property damage insurance, for instance, protects against losses resulting from damage to physical assets like buildings, machinery, or inventory. Legal liability coverage is another critical component, designed to shield businesses from the financial fallout of negligence claims or lawsuits that could otherwise lead to substantial legal expenses.

Employee-related insurance, such as workers’ compensation, covers risks associated with workplace injuries or illnesses, often mandated by law. Additionally, businesses that use vehicles for operations must have commercial auto insurance. This insurance covers damage to company-owned vehicles—whether trucks, buses, or cars—and liability for injuries or damages caused by these vehicles. Compliance with state-specific insurance requirements is crucial to avoid legal penalties and ensure adequate protection.

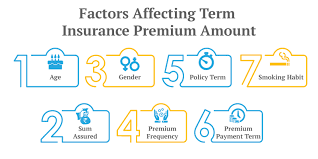

Factors Affecting the Cost of Business Insurance:

The cost of commercial insurance can be influenced by several factors. Key determinants include the number of employees, the business’s location, and the extent of coverage needed. Generally, higher employee counts and broader coverage options will increase policy costs. Moreover, insurance premiums can vary based on regional risks; businesses in areas prone to natural disasters or high crime rates may face higher costs.

For businesses involved in manufacturing or retail, product liability insurance is essential to protect against the financial impact of defective products that cause harm or injury. Without this coverage, businesses could be exposed to costly lawsuits and substantial financial losses. Understanding these factors helps businesses make informed decisions about their insurance needs and manage their insurance budgets effectively.

How to Obtain Commercial Insurance:

To obtain commercial insurance, businesses should start by reaching out to insurance providers to find a policy that fits their specific needs. This process typically involves contacting an insurance agency or directly engaging with an insurance company. An insurance agent can provide valuable guidance, helping to identify appropriate coverage options, offer quotes, and assist with the application process.

Many insurance providers facilitate the application process online or over the phone, making it more convenient for businesses to secure coverage. For small businesses, a Business Owners Policy (BOP) can be a cost-effective solution. A BOP combines several types of insurance coverage into a single package, often leading to significant savings and simplified management. This bundled approach is particularly advantageous for small or home-based businesses, streamlining insurance procurement while ensuring comprehensive protection.