Understanding the Truck Accident Lawyer in 2024:

Understanding the Truck Accident Lawyer in 2024: when handling cases where individuals are injured due to truck accidents caused by someone else’s negligence focuses on personal injury law, specifically related to vehicle accidents involving trucks. They represent clients who have suffered injuries or damages from accidents and work to secure compensation for their losses. The primary goal of a truck accident lawyer is to help clients obtain fair compensation to cover medical expenses, lost wages, and other damages resulting from the accident.

Understanding the Truck Accident Lawyer in 2024: Which deals with civil wrongs and injuries, truck accident lawyers advocate for victims to receive financial restitution for their suffering. Tort law aims to “make the injured party whole again,” meaning that lawyers strive to restore their clients to their pre-accident condition as much as possible. Truck accident lawyers play a crucial role in ensuring that victims are compensated for their injuries and damages by gathering evidence, negotiating with insurance companies, and representing clients in court.

How Does the Federal Reserve’s Interest Rate Decision Affect Mortgage Rates in 2024?

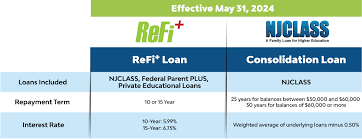

In June 2024, the Federal Open Market Committee (FOMC) decided to keep the federal funds rate unchanged, maintaining it between 5.25% and 5.5%. This decision, which was anticipated by many, reflects the Fed’s ongoing cautious approach in response to persistent inflation and a resilient labor market. The federal funds rate influences mortgage rates indirectly, and by keeping it stable, the Fed aims to manage inflation while providing some predictability for borrowers. The decision marks a continuation of the Fed’s “higher for longer” rates.

Understanding the Truck Accident Lawyer in 2024:Despite expectations of potential rate cuts, the Federal Reserve remains focused on controlling inflation and achieving its 2% target. This cautious stance has contributed to maintaining high mortgage rates, which have reached their highest levels in decades. Real estate experts suggest that the Fed’s ongoing approach may lead to a gradual decline in mortgage rates later in the year. However, for now, borrowers should prepare for elevated interest rates as the Fed continues to monitor economic conditions closely. Real estate experts anticipate that the Fed’s ongoing strategy could gradually lower mortgage rates later this year. However, for the time being, borrowers should brace for elevated interest rates as the Fed actively monitors economic conditions.

How to Compare Refinance Rates Effectively:

When looking to refinance your mortgage, it’s essential to compare rates from multiple lenders to find the best deal. Start by using rate comparison websites such as LendingTree, which aggregate offers from various lenders based on your single application. This method allows you to see a range of rates quickly and efficiently, helping you make an informed decision without having to individually contact each lender. Ensure that you request quotes on the same day, as mortgage rates fluctuate frequently.

Alternatively, you can contact lenders directly for quotes. Whether you visit lenders in person or reach out online, this approach allows for more personalized interaction and might provide additional insights into loan terms and conditions. Engaging with loan officers can also help clarify any questions about the refinancing process and help you find the best possible rate tailored to your financial situation.

When Should You Consider Refinancing Your Mortgage?

Refinancing your mortgage might be beneficial if your current rate is significantly high, generally near or above 8%. However, other factors could also justify refinancing. For instance, switching to a longer-term mortgage can reduce your monthly payments and ease financial pressure if you have a short-term loan with high payments. This can be particularly useful if you are struggling with a 15-year mortgage but would benefit from the flexibility of a 30-year term.

Additionally, refinancing can be advantageous if you have high credit card balances or need to make home repairs. Finance might allow you to use your home equity to pay off high-interest credit card debt or finance home improvements at a lower interest rate than personal loans or credit cards. Another reason to refinance is to eliminate mortgage insurance. If your home’s value has increased and you have at least 20% equity, refinancing could help you remove this extra cost from your monthly payments.